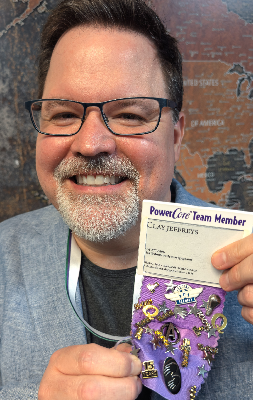

Clay Jeffreys NMLS #211998

Mortgage

404-277-6896

My clients cherish effective communication, and this is a cornerstone of my business. I enjoy learning about new technology, an appreciation of sci-fi and fantasy genre films & TV, and an insatiable interest in nearly all facets of football.